The US government has charged Samuel Bankman-Fried, the founder and former CEO of cryptocurrency exchange FTX, with a host of financial crimes.

It is alleged he intentionally deceived customers and investors to enrich himself and others, while playing a central role in the company’s multibillion-dollar collapse.

Federal prosecutors say that beginning in 2019 Bankman-Fried devised “a scheme and artifice to defraud” FTX’s customers and investors.

He diverted their money to cover expenses, debts and risky trades at his crypto hedge fund, Alameda Research, and to make lavish real estate purchases and large political donations, prosecutors said in a 13-page indictment.

Bankman-Fried was arrested on Monday in the Bahamas at the request of the US government, which charged him with eight criminal violations, ranging from wire fraud to money laundering to conspiracy to commit fraud.

Bankman Fried, one of the largest political donors this year, was also charged with making illegal campaign contributions.

If convicted of all the charges against him, Bankman-Fried could face decades in jail, according to Nicholas Biase, a spokesperson for US prosecutors.

At a press conference on Tuesday, US Attorney Damian Williams called it “one of the biggest frauds in American history”, and said the investigation is ongoing and fast-moving.

He urged anyone who believes they have been victims of the scheme to contact his office.

Bankman-Fried has fallen hard and fast from the top of the cryptocurrency industry he helped to evangelise. FTX filed for bankruptcy on November 11, when it ran out of money after the cryptocurrency equivalent of a bank run.

Before the bankruptcy, he was considered by many in Washington and on Wall Street as a wunderkind of digital currencies, someone who could help take them mainstream, in part by working with policymakers to bring more oversight and trust to the industry.

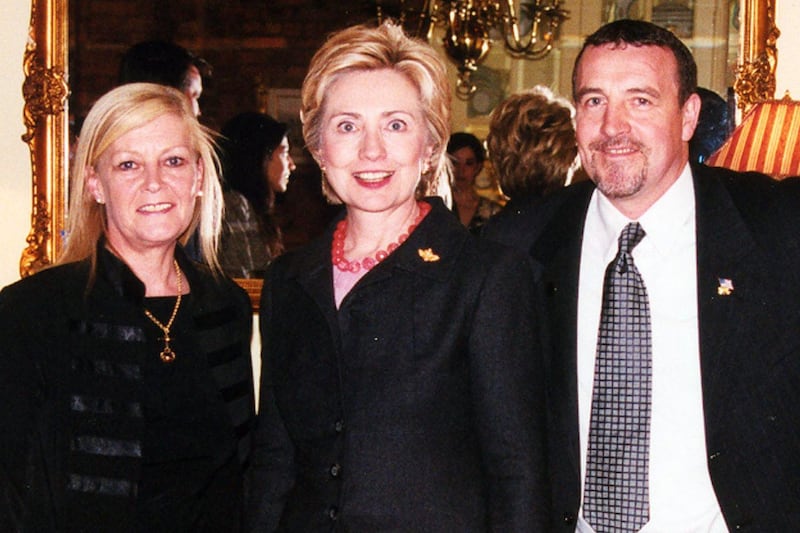

He was worth tens of billions of dollars – at least on paper – and was able to attract celebrities like Tom Brady or former politicians like Sir Tony Blair and Bill Clinton to his conferences at luxury resorts in the Bahamas.

He was the subject of fawning profiles in media, was considered a prominent advocate for a type of charitable giving known as “effective altruism”, and commanded millions of followers on Twitter.

But since FTX’s implosion, Bankman-Fried and his company have been likened to other disgraced financiers and companies, such as Bernie Madoff and Enron.

The criminal indictment against Bankman-Fried and “others” at FTX is on top of civil charges announced on Tuesday by the Securities and Exchange Commission and the Commodity Futures Trading Commission.

The SEC alleges Bankman-Fried defrauded investors and illegally used their money to buy real estate on behalf of himself and his family.

US authorities said they will try to claw back any of Bankman-Fried’s financial gains from the alleged scheme.

A lawyer for Bankman-Fried, Mark S Cohen, said he is “reviewing the charges with his legal team and considering all of his legal options”.

At a congressional hearing on Tuesday that was scheduled before Bankman-Fried’s arrest, the new CEO brought in to steer FTX through its bankruptcy proceedings levelled harsh criticism.

He said there was scant oversight of customers’ money and “very few rules” about how their funds could be used.

John Ray III told members of the House Financial Services Committee that the collapse of FTX, resulting in the loss of more than seven billion dollars, was the culmination of months, or even years, of bad decisions and poor financial controls.

“This is not something that happened overnight or in a context of a week,” he said.

He added: “This is just plain, old-fashioned embezzlement, taking money from others and using it for your own purposes.”

Before his arrest, Bankman-Fried had been holed up in his luxury compound in the Bahamas. US authorities are expected to request his extradition to the US, although the timing of that request is unclear.

At a court hearing in the Bahamas on Tuesday, prosecutors argued that Bankman-Fried was a flight risk and should be held without bail, according to Our News, a broadcast news company based there. His lawyers said he is likely to request a formal extradition hearing.