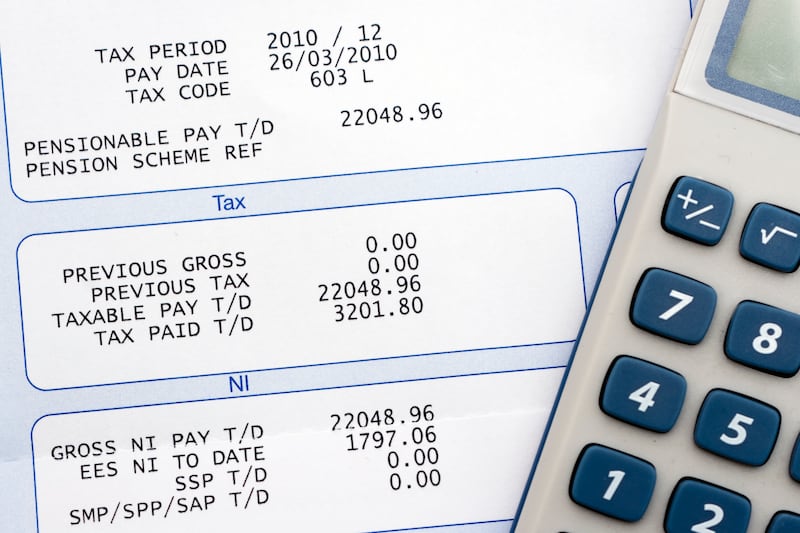

QUESTION: I am an additional rate taxpayer, and I made a maximum pension contribution of £60,000 last year and noted that my PAYE code was changed. I have now received my April 2024 payslip and my code is 2979T. What does this mean?

ANSWER: Most UK employees receive a notice of tax coding from the HM Revenue & Customs at least once a year. Many receive the letter and assume that as it is from the tax office and their employer looks after their tax it must be correct and dispose of the letter without giving it consideration.

A PAYE notice of coding is an important document as it determines the amount of tax which will be deducted from an employee’s income. Your employer is not responsible for ensuring that your coding notice is correct.

Your employer is only responsible for ensuring that the coding you have been given is used to deduct tax from your earnings before they are paid to you. The responsibility for ensuring that the coding notice is correct is your responsibility.

It is quite common for incorrect or out of date coding notices to be issued and if this occurs your employer may be deducting too much tax from you each month, or you may not be paying enough tax. If this is identified at a later date you could be the subject of a tax enquiry. It is therefore essential that all changes to your tax code should be checked each year.

In your case, as an additional rate taxpayer, you will have lost your personal allowance but possibly regained it with your £60,000 pension contribution. The code 2979T means that you can earn £29,790 before paying tax.

What has happened in your case is that HMRC expect you to make a maximum pension scheme contribution again this year and are giving you the tax relief monthly over the year rather than a lump sum refund when you file your tax return.

If you do not intend to make a maximum pension contribution this year or even a smaller contribution you need to contact HMRC immediately and get your code changed otherwise you will get a nasty shock when you file your tax return for 2024/25.

You may also receive benefits as part of your remuneration package such as a company car, private medical insurance etc. It is normal for HMRC to adjust your code to collect the tax on these benefits monthly.

If you are in receipt of other income which is received gross of tax, such as rental income, the Inland Revenue may include a deduction in your tax code to collect the tax due from this income from your salary or pension. This effectively means you would be paying the tax early. You can therefore request that this deduction is not included in your tax code.

A simple phone call to the Inland Revenue is often sufficient to remedy the situation. However, if in any doubt you should seek professional advice.

- Paddy Harty (p.harty@fpmaab.com) is tax partner at FPM Accountants Limited (www.fpmaab.com). The advice in this column is specific to the facts surrounding the question posed. Neither the Irish News nor the contributors accept any liability for any direct or indirect loss arising from any reliance placed on replies.