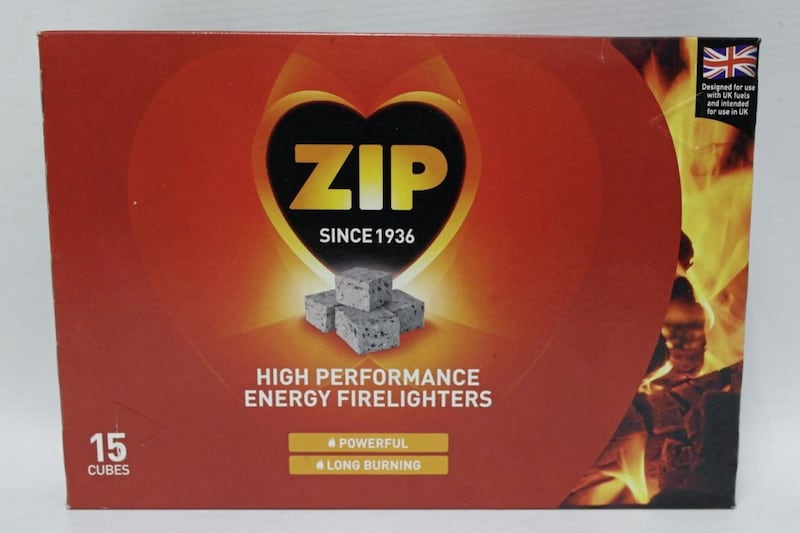

THE north's largest family-owned food and household goods business SHS Group has bought over the £22-million turnover Standard Brands (UK) Ltd in Surrey - a move bringing together the owners of everyday matches brand Maguire & Paterson with that of fire-lighters firm Zip and Sunny Jim.

SHS - whose dozens of brands include WKD alcopops, Shloer, Bottlegreen and Merrydown cider, and which is the market leader in the supply of own label herbs and spices in the UK - hasn't revealed what it paid to sign off the deal.

And although contracts for the transaction have been exchanged, completion of the transaction is subject to clearance by the Irish Competition and Consumer Protection Commission.

Standard Brands is based in Britain, but its manufacturing operations are located in Castlebellingham in Co Louth, and it reports its results in euros.

If ratified, the deal will give SHS - which is owned by the Salters and Sloan families - a key foothold in the EU after Brexit.

Standard Brands employs 110 staff including more than 90 in the Republic, which will bring the SHS Group’s combined workforce to more than 880.

SHS Group chief executive Elaine Birchall said: "Standard Brands complements our existing portfolio, consolidating our position in core markets and extending our brand footprint abroad.

"We look forward to working with them across our combined categories and geographies.”

Standard Brands’ managing director Terry Coates, who will retain day-to-day management of the business, said: “We are delighted to be joining the SHS Group, which is committed to safeguarding the heritage of our business and market-leading products.

"It is an exciting time for Standard Brands and we look forward to working with the SHS management team to capitalise on the many growth opportunities we now have.”

In its latest trading year Standard posted a profit of €953,000 (£852,000) on a turnover of €24.7m (£22.1m)

By contrast, SHS saw a one per cent rise in sales to £379.4 million while its operating profits soared by 23.6 per cent to £21.1m.

Operating from headquarters in the Belfast harbour estate, SHS is the largest private label supplier of herbs and spices and wet condiments and a major supplier of milk puddings in Britain.

Its other premium brands include Farmlea while it distributes a portfolio of well known brands such as Jordans, Ryvita, Nivea, Finish and Mars Drinks.

Carson McDowell and EY Transaction Advisory Services acted as advisers to the SHS Group. Catalyst Corporate Finance acted as lead advisor on the transaction for the sellers together with Goodwin Proctor.