THE impact of Covid-19 contributed to an 85 per cent slump in profit at the north’s biggest lender in the first nine months of 2020.

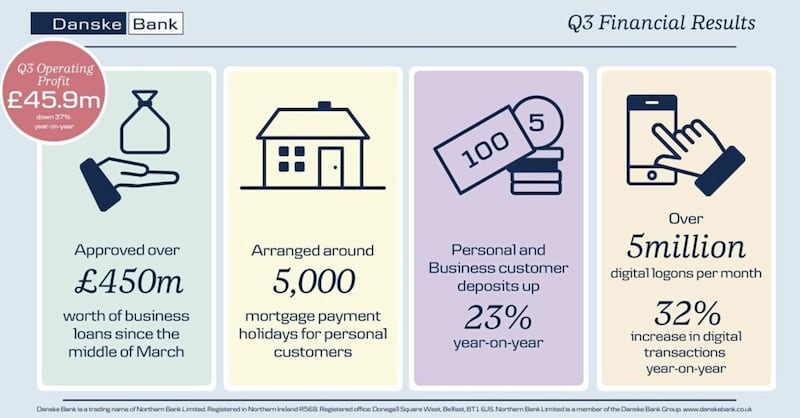

Danske Bank has also revealed that many of its personal and business customers focused on paying off debt and holding cash during the pandemic, with cash deposits up by £1.68 billion (23 per cent) compared with the same period last year.

The lender declared a pre-tax profit of £10.5 million for the year to date in 2020, massively down on the £71.1m pre-tax profit it reported for the same three quarters in 2019.

The bank’s income fell by almost 13 per cent to £153.3m for the first nine months 2020. But it was a £35m loan provision that had the greatest impact on its bottom line.

Loan impairments are factored into financial results for banks in cases where they see a potential that loans may not be repaid in full.

Last year, Danske Bank allowed for ‘loan impairments’ of £1.4m in its third quarter results.

Danske Bank UK’s Belfast-based chief executive Kevin Kingston said the £35m figure reflected both the potential for future loan impairments due to the impact of Covid-19 and historically low interest rates.

The lender said its coronavirus-related support had topped £450m since the middle of March.

Most of it (£370m) was provided via the UK Government backed Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS).

“This assistance spans over 9,000 local business-funding approvals,” said Mr Kingston.

Danske Bank said it had also arranged for around 5,000 mortgage holidays and 675 personal loans and credit card repayment holidays.

The lender’s financial results also pointed to the pandemic’s impact on consumer confidence. It said that many of its customers had focused on paying debt and holding cash, with cash deposits up 23 per cent to £9.056bn.

Danske Bank also said digital transactions were up 32 per cent on last year, with more than five million digital log-ons per month.

“The coronavirus disruption to our economy looks set to continue for longer than we all hoped,” added Mr Kingston.

“Alongside this, Brexit uncertainty still prevails – with less than two months until the transition period ends on 1st January and Northern Ireland’s trading relationship with the rest of the UK changes.”