AIM-listed Irish exploration company Conroy Gold and Natural Resources has announced a placing and subscription to raise £1.9 million.

The additional resources will enable the company to meet the commitments and associated costs on its various

licences in Ireland and Finland, for exploration drilling on the copper/gold licences in Finland, and for general working capital.

The financing has been arranged at 33p per share, being the closing mid-market price of an existing ordinary share on Monday.

Each new ordinary share being issued pursuant to the financing has a one-for-one warrant attached, exercisable at 50p per share with a two-year term.

The company says the placing and subscription of 5,670,449 ordinary shares will raise £1,871,249.

Chairman Professor Richard Conroy said: “We're delighted with the result of the financing which sees a gross amount of £1.87m before costs being added to our existing cash resources and a further £378,751 converted from debt to equity .

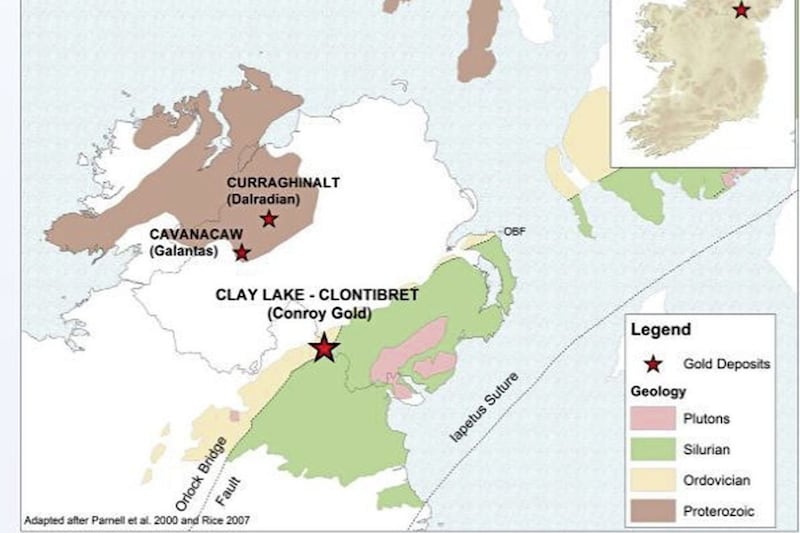

"As announced last month, we have engaged with Demir Export on a proposed joint-venture covering our gold projects in the Longford-Down Massif.

"Demir Export belongs to the Koç Family, which also owns the largest industrial conglomerate in Turkey, a Fortune Global 500 company and Turkey’s leading investment holding company."

Last summer Conroy said it was the early stages of a deal which could see Azerbaijan-focused copper and gold producer Anglo Asian Mining invest up to €7 million in joint ventures to develop a gold mine along the 65km stretch known as the Longford-Down Massif.

Under the deal Anglo Asian Mining - which like Conroy Gold is quoted on London’s Alternative Investment Market - could acquire up to a 55 per cent interest in companies controlling some of Conroy’s key assets, including Clontibret in Co Monaghan, Clay Lake in Co Armagh, and nine other licences in the Republic.