AS we head towards the end of 2021, I think we can say it's been another unpredictable 12 months.

From an economic perspective, there have been some developments that we have been able to take encouragement from in 2021 but there have also been a number of challenges, some that have continued from the previous year and some new ones which have emerged.

As I look back on the last year, here are five key points relating to the Northern Ireland economy in 2021.

1. The coronavirus pandemic remained a key driver of economic performance

Unfortunately, Covid is still very much with us as we approach the end of the year and pandemic-related developments had significant impacts on economic output throughout the year. The restrictions in place to limit the spread of the virus during the first quarter led to a fall in activity levels, but the economy grew strongly in quarter two as those measures were gradually eased.

Economic growth in the UK was positive and above its long-term average in quarter three and, while we don’t yet have the third quarter figures for Northern Ireland, they’re also likely to show a rise in activity levels.

The economy is expected to expand again in quarter four, but the potential impact of the new Omicron coronavirus variant is a source of uncertainty as we head into next year. Overall, the pace of the economic recovery this year has been stronger than expected at the beginning of 2021.

2. The labour market impacts of the pandemic have been more moderate than first anticipated

At the onset of the pandemic in 2020, there were concerns that unemployment could rise sharply as a result of the lockdown and the closure of many businesses. However government support measures appear to have been relatively successful at keeping people in their jobs.

The furlough scheme came to an end in September of this year and while we don’t yet have the data to paint a full picture of the post-furlough labour market, the figures that we do have are encouraging. The unemployment rate in Northern Ireland in the third quarter of the year was 4 per cent – higher than it was at the beginning of 2021, but still low by historical standards.

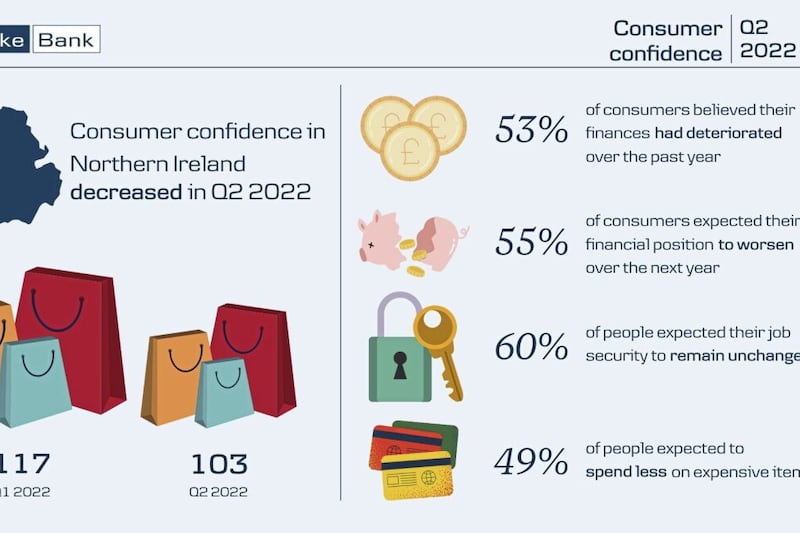

The number of payrolled employees increased by 0.5 per cent in October to the highest on record and while Danske Bank’s overall Northern Ireland Consumer Confidence Index declined in the third quarter of the year, the part of the index based on expectations around job security actually increased compared to the previous quarter.

As more information becomes available we’ll be able to assess the impact of the pandemic on the labour market more fully, but at this point in time, the position is more positive than had initially been expected.

3. Inflationary pressures have emerged

In January of this year, the inflation rate in the UK was 0.7 per cent. In October – the latest available data point – the rate of inflation was 4.2 per cent, more than double the Bank of England’s 2 per cent target. Two of the factors that have contributed to this sharp rise in inflation are higher fuel and energy prices and global supply chain disruption.

The annual inflation rate for electricity, gas and other fuels in October was 22.9 per cent and it exceeded 20 per cent for both petrol and diesel. While these stark numbers relate to consumer price inflation, it’s also important to note that increases in energy prices affect businesses and can put upward pressure on wider inflation if firms raise their prices in response to the higher costs

An example of the supply shortages can be seen in the October inflation data with the price of used cars up by 22.8 per cent. The shortage of semiconductors has adversely impacted the production of new vehicles and led to increased demand, and prices, for second hand ones.

I, like many other economists, expect this period of high inflation to be temporary but how long it will persist is unclear and, as a result of this higher rate of price rises, I think we’re likely to see an increase in the Bank of England base rate in the months ahead.

4. Uncertainty persists regarding the post-Brexit trading arrangements in Northern Ireland

The Northern Ireland Protocol, which effectively keeps Northern Ireland within the EU single market for goods, has led to new checks and processes when moving some goods from Great Britain into Northern Ireland. In July of this year, the UK Government published a paper setting out its proposals for amending the Protocol.

Then in October, the EU published its proposals relating to the Protocol. The UK and EU are currently negotiating to try and agree a way forward with regards to the implementation of the Protocol.

However, there is still uncertainty about what the outcome of that engagement will be and businesses are still waiting for the clarity they need to most effectively plan for the future.

5. 2021 was another strong year for the housing market

This has been another year of strong price growth in the Northern Ireland housing market. The latest data for the third quarter of the year showed a 10.7 per cent annual rise in the standardised house price, up from 9.7 per cent in quarter two and 5.9 per cent in the first quarter.

A number of factors including people re-evaluating their housing needs, some people building up higher levels of savings which could be used to help buy a property, low interest rates, the stamp duty holiday and supply constraints have all contributed towards the relatively high house price growth observed this year.

As we look towards 2022, there is still a lot of uncertainty around the economic outlook. In terms of the annual economic growth rate, we’ll likely see another relatively high rate of expansion next year.

But there are a number of headwinds that could affect the performance of the economy, including the potential impact of the new Omicron coronavirus variant, high inflation, labour shortages and supply chain disruption to name a few.

While recognising the uncertainty and the challenges, let’s hope that there are also some positives that I can include when I write my year in review article for 2022.

:: Conor Lambe is chief economist at Danske Bank