Optimism in the north’s business community hit its highest point for almost three-years last month, following the restoration of the executive at Stormont.

New analysis from Ulster Bank shows the surge in optimism during February came as business activity and new orders grew at the fastest pace since March 2023.

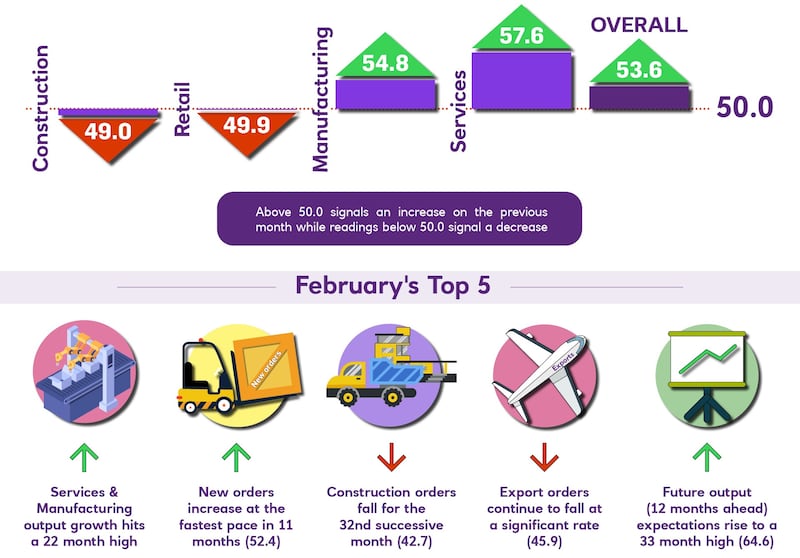

The lender’s monthly business survey suggests the growth during February was driven by the services and manufacturing sectors, which recorded the fastest rate of expansion in activity in 22 months.

Output in the retail and construction sectors was marginally down.

Overall, February’s purchasing managers’ index (PMI) marked the third successive month of increasing output in the private sector.

Based on the experiences of 200 businesses across the north’s construction, manufacturing, retail and services sectors, the PMI is considered a trusted litmus test for the performance of the economy here.

The strong performance during February came during a period when the UK officially declared a technical recession.

The Office for National Statistics estimated that UK gross domestic product (GDP) fell by 0.3% in the final three months of last year.

It followed a decline of 0.1% in the previous quarter.

- Britain fell into recession in 2023, but did Northern Ireland?Opens in new window

- EY: Northern Ireland economy ‘to expand by 0.7%’ in 2024, but job growth expected to “stall” this yearOpens in new window

- PMI: North’s businesses begin 2024 on upward note, with optimism at 32-month highOpens in new window

Analysis of economic output by Northern Ireland’s own statistics body Nisra, suggests the north’s economy may not have contracted in the same way last year.

The closet thing Nisra has for measuring GDP is the Northern Ireland Composite Economic Index (NICEI).

The latest index showed output grew by 0.6% in the third quarter of 2023.

The results of the fourth quarter 2023 index will be published at the end of this month.

But Ulster Bank’s PMI suggests the Northern Ireland private sector at least, has started 2024 on a growth footing.

The analysis, carried out by S&P Global for Ulster Bank, said the growth during February was “solid and the fastest since March 2023″.

Respondents to the survey linked higher activity to rising new orders.

“In some cases, previously delayed projects have been released, helping to build a pipeline of new work,” said the researchers.

“As such, new orders increased for the second month running in February.”

Ulster Bank’s chief economist, Richard Ramsey, said the pick-up in demand during February appeared to be largely domestically driven.

He said export orders have now contracted for 10 months in succession.

February’s PMI also noted that shipping delays due to the Red Sea crisis caused longer delivery times and added to cost burdens.

“Rising wages and higher shipping costs resulting from the Red Sea crisis helped propel input cost inflation to a nine-month high,” said Mr Ramsey.

“This was most notable amongst manufacturers.”

Both manufacturers and retailers reported a marked lengthening in supplier delivery times.

“Encouragingly, this is not the case within construction. Indeed, construction firms continued to report a shortening in their supplier delivery times and input costs within the building industry eased to their lowest rate in 44 months,” he said.

The economist said the return of the Executive had undoubtedly boosted business confidence.

“Some survey respondents said that an unblocking of previously delayed work is helping to build a pipeline of new activity,” he said.

“Sentiment was particularly strong amongst manufacturers, with optimism about future output at a record high.

“Even the beleaguered construction industry is now relatively optimistic about output in 12 months’ time.”