Two Belfast men who admitted charges of fraud linked to ‘bounce back’ loans they received during the Covid 19 pandemic have avoided jail.

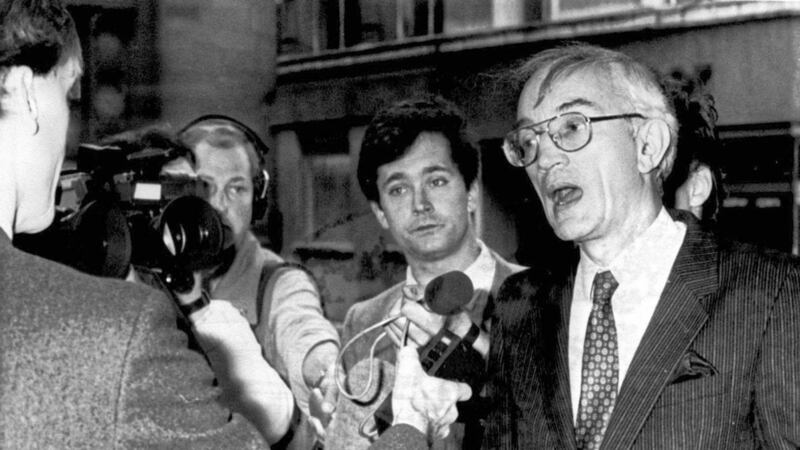

Darren Service (43) and 28-year old Adam Boyd appeared at Belfast Crown Court where they were sentenced by Judge Mark Reel.

Service, from Ballysillan Road, admitted that on May 11, 2020 he made a false representation in respect of a bounce back loan application and for the offence he had a sentence of 22 months imposed which was suspended for three-and-a-half years.

From Primrose Street, Boyd admitted a similar offence in that on May 8, 2020 he made a false representation in respect of a bounce back loan application. He was handed a 22-month sentence which was suspended for two-and-half years.

During Monday’s sentencing, it emerged that during a search of Service’s home in March 2022, a safe was located which contained £131,930.

Service told police that he owned and ran various gyms in Belfast and Coleraine and a financial investigation into his business ventures was launched.

As a result of the police probe, it emerged that Service applied for a loan for £40,000 as a director of Darren Service Limited.

This application was made in May 2020 as part of the Government’s ‘bounce back’ scheme which was set up to support small businesses during the Covid pandemic.

In his application, he claimed that the turnover of Darren Service Limited trading as Flex Gym NI was £160,000 - but company accounts established that the turnover was significantly less.

Judge Reel said “by fraudulently overstating his turnover, he obtained a loan for £40,000″ and after receiving the loan, Service “transferred £27,000 to his personal account and took out £10,000 in cash.”

The Judge added: “Repayments to the loan should have commenced in May 2021 but to date the funds have not been repaid and £40,425.58 remains outstanding.”

When he was interviewed by the PSNI about the loan in September 2022, Service refused to answer any questions.

Regarding Boyd’s offending, the court heard AB Fitness Limited trading as Fitness Hub was set up in December 2019 and he was listed as the sole director.

Within the account opening agreement, Boyd stated that the expected turnover for the business would be £40,000.

Six months later, Boyd applied for a bounce back loan and at this point he stated that the business turnover would be £200,000.

Judge Reel said that a loan was granted and paid to the business for £50,000 when the “genuine figures” would have resulted in a much lower loan.

He added that in Boyd’s case, whilst the prosecution “cannot say what the funds were used for”, his defence have submitted some of the money was used ‘to make ends meet’ while other funds were used ‘to support the fledgling business.’

Boyd was also interviewed by police in September 2022 and claimed that he over-estimated the turnover in good faith and genuinely believed that’s what the business could have turned over.

Boyd also claimed that Service kept some of the loan money he received in his safe.

Judge Reel revealed £9,300 had been repaid on behalf of AB Fitness Limited.

The Judge said he had considered defence submissions made on behalf of both defendants.

He noted Service’s caring responsibilities for his daughter, his association with running gyms and the acceptance of his offending to Probation.

Boyd’s submissions highlighted his career in personal fitness, his recovery from a serious accident earlier this year and his remorse for offending.

Judge Reel said: “I have no reason to doubt that Mr Service did anything other than take a calculated opportunity to falsify his business records and thereby obtain money to which he was not entitled.”

Regarding Boyd, the Judge added: “I do not accept for one moment that he believed the figure of £200,000 was a genuine representation of the likely turnover of his business.”

Branding the offending as a “serious abuse of a public scheme””, Judge Reel spoke of the efforts Boyd has made to repay some of the money as well as Service’s assertion that the cash found in his safe could be released to repay the loan in full.