The number of mortgages approved to home-buyers increased in February to the highest level seen since the month the mini-budget was delivered under former prime minister Liz Truss.

Some 60,383 mortgage approvals for house purchase were recorded, marking the highest figure since 65,349 deals got the go-ahead in September 2022, according to Bank of England figures.

It was also the first time since September 2022 that mortgage approvals for house purchase have been above the 60,000 mark.

Mortgage rates rocketed amid market turmoil, following the launch of the mini-budget on September 23 2022, with the average two- and five-year fixed mortgage rates on the market surging above 6% and later easing back.

More recently, signs that inflation is easing have bolstered hopes for a cut in the Bank of England base rate.

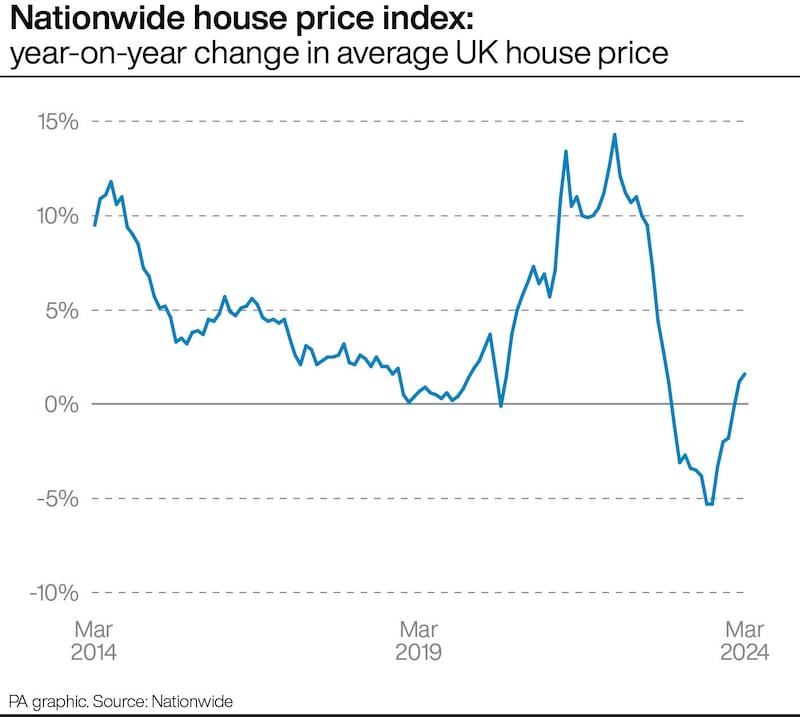

Nationwide Building Society also reported on Tuesday that the average UK house price fell by 0.2% month on month in March.

However, the fall was described by some economists as a “blip” or temporary interruption to house price growth.

The Bank’s Money and Credit report said the “effective” interest rate – the actual interest typically paid – on newly-drawn mortgages fell by 29 basis points, to 4.90% in February.

Lucian Cook, head of residential research at estate agent Savills, said: “A small monthly fall in house prices in March is a reminder that, despite a stabilisation in mortgage rates, affordability pressures remain for mortgaged buyers.

“Encouragingly, mortgage approvals for house purchases continued to pick up in February, rising above 60,000 for the first time since September 2022.

“However, they remain below their pre-pandemic norm of around 66,000, in a market where cash and equity-rich buyers still have a competitive buying advantage.”

Simon Gammon, managing partner at Knight Frank Finance, said he “wouldn’t be surprised” to see approvals for house purchase moving above the 70,000 mark later this year.

The figures were released as credit information company Experian said mortgage applications in the first two months of 2024 have indicated that consumers are returning to the market.

Experian said West Cumbria, Manchester, South Teesside and Blackpool in northern England, Edinburgh and North Lanarkshire in Scotland, and Birmingham and Leicester in the Midlands have all seen particularly strong growth in mortgage applications in the first two months of 2024 compared with a year earlier.

At the other end of the spectrum, the Causeway Coast and Glens in Northern Ireland, the Isle of Wight, Plymouth in the South West of England and Caithness and Sutherland, Ross and Cromarty and South Ayrshire in Scotland have seen relatively small increases in mortgage applications, according to Experian’s data.

John Webb, Experian consumer affairs manager, said: “It’s encouraging to see the start of a shift in consumer attitudes to mortgage applications.

“But the reality is that many people are still hesitant, as mortgage rates remain relatively high. What we are seeing is therefore likely the first green shoots of a long road to recovery and return to market – after the huge impact the pandemic has had on our economy.”

Andrew Montlake, managing director of Coreco mortgage brokers said: “After the Easter break, I suspect we will see a further rise in activity as pent-up demand from buyers, further buoyed by the easing of mortgage rates and criteria, acts to keep property prices from falling further…

“We are hopefully standing on the precipice of a continued reduction of inflation and a stabilisation of interest rate movements which will allow lenders to price more competitively and keep rates around for longer, rather than the sharp staccato changes we have been seeing for too long now.”

Looking at non-mortgage borrowing, the Bank of England figures showed that the annual growth rate for consumer credit slowed from 9.0% to 8.7%.

Consumer credit includes borrowing such as credit cards, overdrafts, personal loans and car finance.

Adam Butler, public policy manager at StepChange Debt Charity, said: “While for some borrowing may indicate rising confidence, for others it will be an emergency response to being unable to make ends meet.”

He added: “There’s a real risk that rising borrowing equates to a worsening of the debt situation for some households.”

In February, household deposits with banks and building societies rose by £6.0 billion, marking the fifth monthly increase in a row.

In February, UK non-financial businesses made net repayments of £3.3 billion-worth of loans from banks and building societies, including overdrafts, compared with £0.2 billion of net repayments in January.

Meanwhile, UK non-financial businesses deposited £1.8 billion with banks and building societies in all currencies, following withdrawals of £19.9 billion in January.

Susannah Streeter, head of money and markets, Hargreaves Lansdown, said: “Although the light at the end of the tunnel of painfully high borrowing costs is shining that bit brighter, there is still a dark space to crawl through before companies and consumers feel significantly more financially secure.”